Recently InternetX and Sedo released the 2023 Global Domain Report.

The report provides a wealth of information of interest to domain investors. It includes a detailed analysis of Sedo sales and search data, and premium domain name sales overall. In addition, it looks at registration and hosting data from around the world.

The report also includes a rich collection of opinions and forecasts from a diverse group of domain industry experts.

The report is lengthy, 74 pages. I present below a selection of data of particular relevance for domain name investors. Anyone can download the full 2023 Global Domain Report free, in exchange for your contact information.

Registration Picture

The 349.9 million domain registrations represented an overall drop of 4% year-over-year.

African country code domains increased 30% year-over-year, though.

Another strong increase in registrations was .cn, up 18.4% from previous year.

In terms of year to year, .com was up slightly, 1.5%, as was .org, up 1.9%, while .net suffered a 2.2% decline in registrations.

While .xyz dominates new gTLDs in terms of total registrations, 14.8% of all new extensions according to the report, the year-over-year growth in .xyz registrations was a modest 1.9%.

The big jumps in year-over-year registrations among the new extensions were .shop, up 48.3%, .cyou ,up 46.4%, and .top, up 29.9%. The .icu and .store extensions were also up about 25%. All of these were driven by deeply-discounted first year registration rates.

Extension Releases

The 2023 Global Domain Report lists TLDs that reached general availability in 2022, including .day, .boo, .kids and .rsvp.

The report also indicates TLDs that Google Registry will launch in 2023, .dad, .esq, .foo, .ing, .meme, .nexus, .phd, .prof and .zip.

It became possible during 2022 to register .au domain names at the second level.

The Hosting Picture

I was somewhat surprised that 63.4% of websites are hosted in North America, with 19.6% in Asia, and 14.5% in Europe. The other continents represent only a small part of global hosting.

However, if one looks at new gTLD domains, the hosting picture is very different, with 44.2% hosted in China, versus 26.9% in the USA.

The Majestic Million

The Majestic Million is a ranking of domain names according to popularity in search engines. The list is dominated by .com, that takes up just under half of the Majestic Million at 498,901. The clear second place is now .org, at 84,327, followed by .net at 37,320.

The rest of the top 10 are all country codes, with .ru, .uk, .de, .cn, .jp and .nl in that order.

Any particular new extension individually represents less than 6000 entries on the Majestic Million. There are some surprises, however. The top 5 among the new extensions in Majestic Million listings, in order, are .top, .quest, .xyz, .monster and .shop.

Different Regions, Different Extensions

The report has an atlas section that looks at market share, measured in terms of web use, although the methodology is not completely transparent.

For example, in the United Kingdom, 63.9% are .uk (including third level use), compared to 25% for .com, and less than 2.5% for anything else individually. If we look only at new extensions in the United Kingdom market, they show .xyz as most important, followed by .club, .online, .bar and .london.

Contrast that with the situation in the United States, where the report shows 70.1% share for .com, followed by 5.6% for .net, 4.7% for .org, 1.8% for .us, 1.7% for .info, 1.6% for .xyz, 1.5% for .co, and 0.9% for .online.

In general, their own country code does well in most European countries. For example, in Germany the .de represents 67.7% of market share, followed by .com at 16.3%, .net at 2.8%, and .eu at 2.7%. The .org, .info, .online and .xyz extensions also made the top ten in Germany.

If we look at China, .com is in first place at 29.6%, but barely edging out .cn at 26.3%. Next on list were .top at 9.0%, .icu at 7.7%, .xyz at 4.0%, .wang at 2.4%, .vip at 2.1%, .net at 2.0% and .win at 1.3%.

The situation in India shows .com and the local country code, .in, at 47.6% and 34.4% respectively. The next extensions, in order, are .org at 2.5%, .online at 2.3%, .xyz at 2.2%, .net at 2.0%, followed by .ooo, .club, .co and .info.

South Africa is dominated by the .za country code, with 67.7%, followed by .com at 21.8%. The .africa TLD comes third with 1.7% of market, a near tie with .net, also at 1.7%. Several other extensions including .org, .online and .co are on the top 10, but all less than 1% individually.

In Brazil the .br dominates with 75.7% of market share, followed by .com at 17%, .online at 1.5%, and .net at 1.2%. The next two were .top and .xyz, followed by .org. Interestingly, .fun made the top 10 in Brazil, as did .club and .men, although all with less than 0.5% of market share.

The message I see here for domain investors is that different regions have very different extension adoption. If you are acquiring a name that is intended for a particular region, make sure the extension is congruent with the preferences for that region.

Sedo Sales Data

Only Sedo sales of $2000 and up get reported on NameBio, minus those where sale privacy has been purchased. That distorts the view of what sells at Sedo, suggesting higher average prices, and this analysis had access to the full record of Sedo sales.

Here are some interesting points:

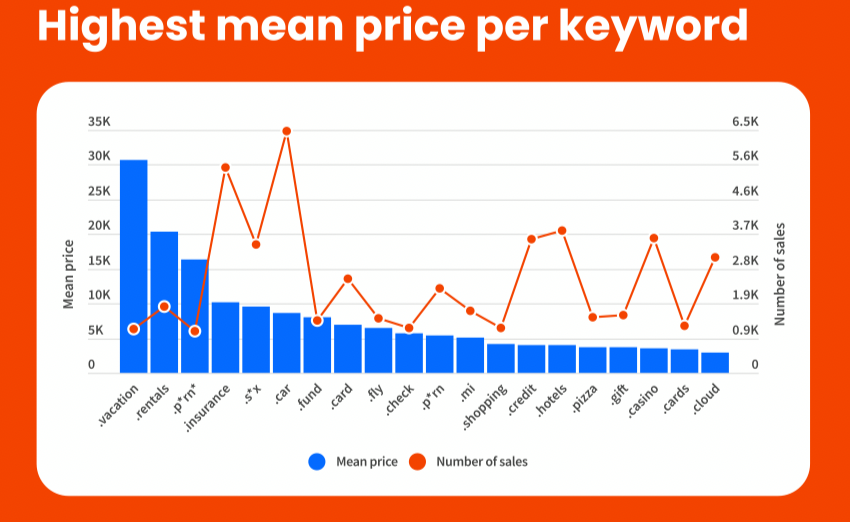

The report provides interesting data on the mean sales price (blue) for domains with different keywords, along with the number of sales (in red). Vacation and rentals lead in terms of average price, but the terms insurance and car had more sales.

The Integrated Premium Sales Picture

The analysts for the report had access to a very large dataset that integrated both registry premium sales and aftermarket sales data. Since almost all registries are no longer reporting premium sales to NameBio, this provides a unique picture of names selling, not just the aftermarket sales from the venues reported in NameBio.

With this integrated dataset, 33.6% of ‘premium’ sales are in the .com extension. This seems low to me, and I presume they did not have access to the Afternic sales data. Surprisingly, the second place was .art, with 9.2%. No other single TLD had more than 3%.

Big Movers

The report also looked at the TLDs that grew most strongly. I was surprised to see .foundation at the top, a 260% rise in 2022. Although when I checked at nTLDStats, that increase has now levelled off, and the total number of registrations in the TLD is less than 32,000.

With its strongly growing economy, the country code for India, .in was next, with a 197% growth.

With interest in the fediverse, and Mastodon in particular, it is not surprising that .social was next, with a 153% increase. Many of the more popular Mastodon instances use the .social extension.

Top Sedo Sales

The report includes the top Sedo sales for the 2022 years, both overall and by certain extensions. The top sale was

The top .org sale at Sedo for the year was

The top .io sale was

The top .co sale was broadcast.co at $27,845, closely followed by

Among new gTLDs,

How Important is Sedo MLS?

Unlike Afternic Fast Transfer, that only applies to a handful of mainly legacy TLDs, the Sedo MLS applies to many TLDs, including many country codes and most new extensions.

During 2022, 48% of Sedo sales were via the MLS network, and 52% were directly at Sedo. Two of the names that sold via the MLS network were publicly-disclosed 6-figure sales.

The NamePros Blog covered fast transfer networks a few months ago: A Deeper Look At Domain Name Fast Transfer Sales Networks.

Buy Now or Make Offer?

The report presented a breakdown by form of pricing. 74% of sales were at buy now prices, while 11% were as a result if make offer. Another 9% were auctions, and 6% were other. I am not clear what that is, possibly imported leads.

If we combine this information, with the MLS data from the previous section, it seems that for most domain names it is best to use buy-now pricing and to activate MLS if available for that domain name.

Events of the Year 2022

On page 4 of the report is a graphical presentation of industry highlights from 2022. While most of these are familiar to investors, such as the Dan acquisition by GoDaddy in June, probably a few will be new.

Near the end of the report, they provide an outlook for 2023. They see a return to pre-pandemic domain activity in general, but note the following reasons for optimism:

In terms of country codes, they see Africa outperforming the market, due to rapidly expanding Internet and technology adoption on the continent.

After noting that new gTLD sales have increased steadily over time, they see that continuing, particularly in Asia.

Final Thoughts

Domain data is important to inform our domain name investing, and I truly appreciate the detailed data provided in the 2023 Global Domain Report. I urge you to download and read the full report.

InternetX and Sedo are part of an integrated company that had an initial public offering early in 2023. That integrated public company includes IONOS, Sedo, InternetX, United-Domains, Fasthosts and several other businesses.

Sedo was founded in 2000 by three students. Information circulated in advance of public offering, and reported by Andrew Allemann of DNW, indicated that Sedo had a revenue of about $150 million per year. They also reported aftermarket sales volume increased 48% from 2019 to 2021.

InternetX is even older, founded in the Bavarian city of Regensburg in 1998. They offer a broad array of registrar, hosting and security services.

So, what information stood out to you in the 2023 Global Domain Report? Share in the comment section below.

The report provides a wealth of information of interest to domain investors. It includes a detailed analysis of Sedo sales and search data, and premium domain name sales overall. In addition, it looks at registration and hosting data from around the world.

The report also includes a rich collection of opinions and forecasts from a diverse group of domain industry experts.

The report is lengthy, 74 pages. I present below a selection of data of particular relevance for domain name investors. Anyone can download the full 2023 Global Domain Report free, in exchange for your contact information.

Registration Picture

The 349.9 million domain registrations represented an overall drop of 4% year-over-year.

African country code domains increased 30% year-over-year, though.

Another strong increase in registrations was .cn, up 18.4% from previous year.

In terms of year to year, .com was up slightly, 1.5%, as was .org, up 1.9%, while .net suffered a 2.2% decline in registrations.

While .xyz dominates new gTLDs in terms of total registrations, 14.8% of all new extensions according to the report, the year-over-year growth in .xyz registrations was a modest 1.9%.

The big jumps in year-over-year registrations among the new extensions were .shop, up 48.3%, .cyou ,up 46.4%, and .top, up 29.9%. The .icu and .store extensions were also up about 25%. All of these were driven by deeply-discounted first year registration rates.

Extension Releases

The 2023 Global Domain Report lists TLDs that reached general availability in 2022, including .day, .boo, .kids and .rsvp.

The report also indicates TLDs that Google Registry will launch in 2023, .dad, .esq, .foo, .ing, .meme, .nexus, .phd, .prof and .zip.

It became possible during 2022 to register .au domain names at the second level.

The Hosting Picture

I was somewhat surprised that 63.4% of websites are hosted in North America, with 19.6% in Asia, and 14.5% in Europe. The other continents represent only a small part of global hosting.

However, if one looks at new gTLD domains, the hosting picture is very different, with 44.2% hosted in China, versus 26.9% in the USA.

The Majestic Million

The Majestic Million is a ranking of domain names according to popularity in search engines. The list is dominated by .com, that takes up just under half of the Majestic Million at 498,901. The clear second place is now .org, at 84,327, followed by .net at 37,320.

The rest of the top 10 are all country codes, with .ru, .uk, .de, .cn, .jp and .nl in that order.

Any particular new extension individually represents less than 6000 entries on the Majestic Million. There are some surprises, however. The top 5 among the new extensions in Majestic Million listings, in order, are .top, .quest, .xyz, .monster and .shop.

Different Regions, Different Extensions

The report has an atlas section that looks at market share, measured in terms of web use, although the methodology is not completely transparent.

For example, in the United Kingdom, 63.9% are .uk (including third level use), compared to 25% for .com, and less than 2.5% for anything else individually. If we look only at new extensions in the United Kingdom market, they show .xyz as most important, followed by .club, .online, .bar and .london.

Contrast that with the situation in the United States, where the report shows 70.1% share for .com, followed by 5.6% for .net, 4.7% for .org, 1.8% for .us, 1.7% for .info, 1.6% for .xyz, 1.5% for .co, and 0.9% for .online.

In general, their own country code does well in most European countries. For example, in Germany the .de represents 67.7% of market share, followed by .com at 16.3%, .net at 2.8%, and .eu at 2.7%. The .org, .info, .online and .xyz extensions also made the top ten in Germany.

If we look at China, .com is in first place at 29.6%, but barely edging out .cn at 26.3%. Next on list were .top at 9.0%, .icu at 7.7%, .xyz at 4.0%, .wang at 2.4%, .vip at 2.1%, .net at 2.0% and .win at 1.3%.

The situation in India shows .com and the local country code, .in, at 47.6% and 34.4% respectively. The next extensions, in order, are .org at 2.5%, .online at 2.3%, .xyz at 2.2%, .net at 2.0%, followed by .ooo, .club, .co and .info.

South Africa is dominated by the .za country code, with 67.7%, followed by .com at 21.8%. The .africa TLD comes third with 1.7% of market, a near tie with .net, also at 1.7%. Several other extensions including .org, .online and .co are on the top 10, but all less than 1% individually.

In Brazil the .br dominates with 75.7% of market share, followed by .com at 17%, .online at 1.5%, and .net at 1.2%. The next two were .top and .xyz, followed by .org. Interestingly, .fun made the top 10 in Brazil, as did .club and .men, although all with less than 0.5% of market share.

The message I see here for domain investors is that different regions have very different extension adoption. If you are acquiring a name that is intended for a particular region, make sure the extension is congruent with the preferences for that region.

Sedo Sales Data

Only Sedo sales of $2000 and up get reported on NameBio, minus those where sale privacy has been purchased. That distorts the view of what sells at Sedo, suggesting higher average prices, and this analysis had access to the full record of Sedo sales.

Here are some interesting points:

- The average sales price was $2146.

- The median sales price at Sedo was $400. That is half of all sales were at prices of $400 or less.

- Sedo sold domains in 365 different TLDs in 2022.

- 74% of all sales were buy now.

The report provides interesting data on the mean sales price (blue) for domains with different keywords, along with the number of sales (in red). Vacation and rentals lead in terms of average price, but the terms insurance and car had more sales.

Plot of mean price and number of sales for high-value keywords. Data and image courtesy of InternetX-Sedo 2023 Global Domain Report.

The Integrated Premium Sales Picture

The analysts for the report had access to a very large dataset that integrated both registry premium sales and aftermarket sales data. Since almost all registries are no longer reporting premium sales to NameBio, this provides a unique picture of names selling, not just the aftermarket sales from the venues reported in NameBio.

With this integrated dataset, 33.6% of ‘premium’ sales are in the .com extension. This seems low to me, and I presume they did not have access to the Afternic sales data. Surprisingly, the second place was .art, with 9.2%. No other single TLD had more than 3%.

Big Movers

The report also looked at the TLDs that grew most strongly. I was surprised to see .foundation at the top, a 260% rise in 2022. Although when I checked at nTLDStats, that increase has now levelled off, and the total number of registrations in the TLD is less than 32,000.

With its strongly growing economy, the country code for India, .in was next, with a 197% growth.

With interest in the fediverse, and Mastodon in particular, it is not surprising that .social was next, with a 153% increase. Many of the more popular Mastodon instances use the .social extension.

Top Sedo Sales

The report includes the top Sedo sales for the 2022 years, both overall and by certain extensions. The top sale was

call.com at $1.6 million, followed by yachts.com at $600,000.The top .org sale at Sedo for the year was

proton.org at $125,000, while top .net came in at $45,000.The top .io sale was

mode.io at $50,000,The top .co sale was broadcast.co at $27,845, closely followed by

pagoda.co, law.co and game.co.Among new gTLDs,

best.casino was the top sale at $60,000, followed by algo.xyz at $50,000 and wallet.oneHow Important is Sedo MLS?

Unlike Afternic Fast Transfer, that only applies to a handful of mainly legacy TLDs, the Sedo MLS applies to many TLDs, including many country codes and most new extensions.

During 2022, 48% of Sedo sales were via the MLS network, and 52% were directly at Sedo. Two of the names that sold via the MLS network were publicly-disclosed 6-figure sales.

The NamePros Blog covered fast transfer networks a few months ago: A Deeper Look At Domain Name Fast Transfer Sales Networks.

Buy Now or Make Offer?

The report presented a breakdown by form of pricing. 74% of sales were at buy now prices, while 11% were as a result if make offer. Another 9% were auctions, and 6% were other. I am not clear what that is, possibly imported leads.

If we combine this information, with the MLS data from the previous section, it seems that for most domain names it is best to use buy-now pricing and to activate MLS if available for that domain name.

Events of the Year 2022

On page 4 of the report is a graphical presentation of industry highlights from 2022. While most of these are familiar to investors, such as the Dan acquisition by GoDaddy in June, probably a few will be new.

- The report lists where the various former Uniregistry TLDs ended up, with Nova Registry acquiring .link, XYZ acquired .audio, .flowers, .game, .hosting, .lol and several others. The .blackfriday and .photo extensions ended up at GoDaddy.

- Several significant sales were noted, including NFTs.com for $15 million, the second largest public domain name sale, and sports.gg for $95 thousand, the highest-value public domain name sale in that extension.

- The report notes the rebranding of Donuts and Aflias as Identity Digital.

- ICANN President and CEO Göran Marby stepped down in December.

- In October, they note the termination of the decentralized .coin blockchain TLD by Unstoppable Domains because of name collision.

- Another expansion by XYZ Inc was .lat, added in August, to become the 34th extension held by the company. The .lat extension is intended for Latin America.

- The .help extension was assigned by ICANN in June.

Near the end of the report, they provide an outlook for 2023. They see a return to pre-pandemic domain activity in general, but note the following reasons for optimism:

The accelerating proliferation of AI and technology, the increase in global internet users, the continued growth of mobile device usage, and the rise of SaaS and e-commerce platforms, all contribute to TLDs growing market value.

In terms of country codes, they see Africa outperforming the market, due to rapidly expanding Internet and technology adoption on the continent.

After noting that new gTLD sales have increased steadily over time, they see that continuing, particularly in Asia.

This (new gTLD) growth is driven in particular by Asia and China’s growing demand for domain names and by particular niches like the tech, AI and Web3 segments investing more and more in .xyz, .io and .ai. This trend will be followed by more niches entering this TLD category.

Final Thoughts

Domain data is important to inform our domain name investing, and I truly appreciate the detailed data provided in the 2023 Global Domain Report. I urge you to download and read the full report.

InternetX and Sedo are part of an integrated company that had an initial public offering early in 2023. That integrated public company includes IONOS, Sedo, InternetX, United-Domains, Fasthosts and several other businesses.

Sedo was founded in 2000 by three students. Information circulated in advance of public offering, and reported by Andrew Allemann of DNW, indicated that Sedo had a revenue of about $150 million per year. They also reported aftermarket sales volume increased 48% from 2019 to 2021.

InternetX is even older, founded in the Bavarian city of Regensburg in 1998. They offer a broad array of registrar, hosting and security services.

So, what information stood out to you in the 2023 Global Domain Report? Share in the comment section below.

Last edited: